Startling costs can happen abruptly and possibly burn through every last dollar, yet finding out about the upsides and downsides of utilizing persona

Startling costs can happen abruptly and possibly burn through every last dollar, yet finding out about the upsides and downsides of utilizing personal loans by Personal Loan Pro to help you.

Foreseeing when a monetary crisis will happen is incomprehensible. Considering the financial difficulty brought about by the continuous worldwide pandemic, it tends to be trying to carve out an opportunity to set every one of your funds up.

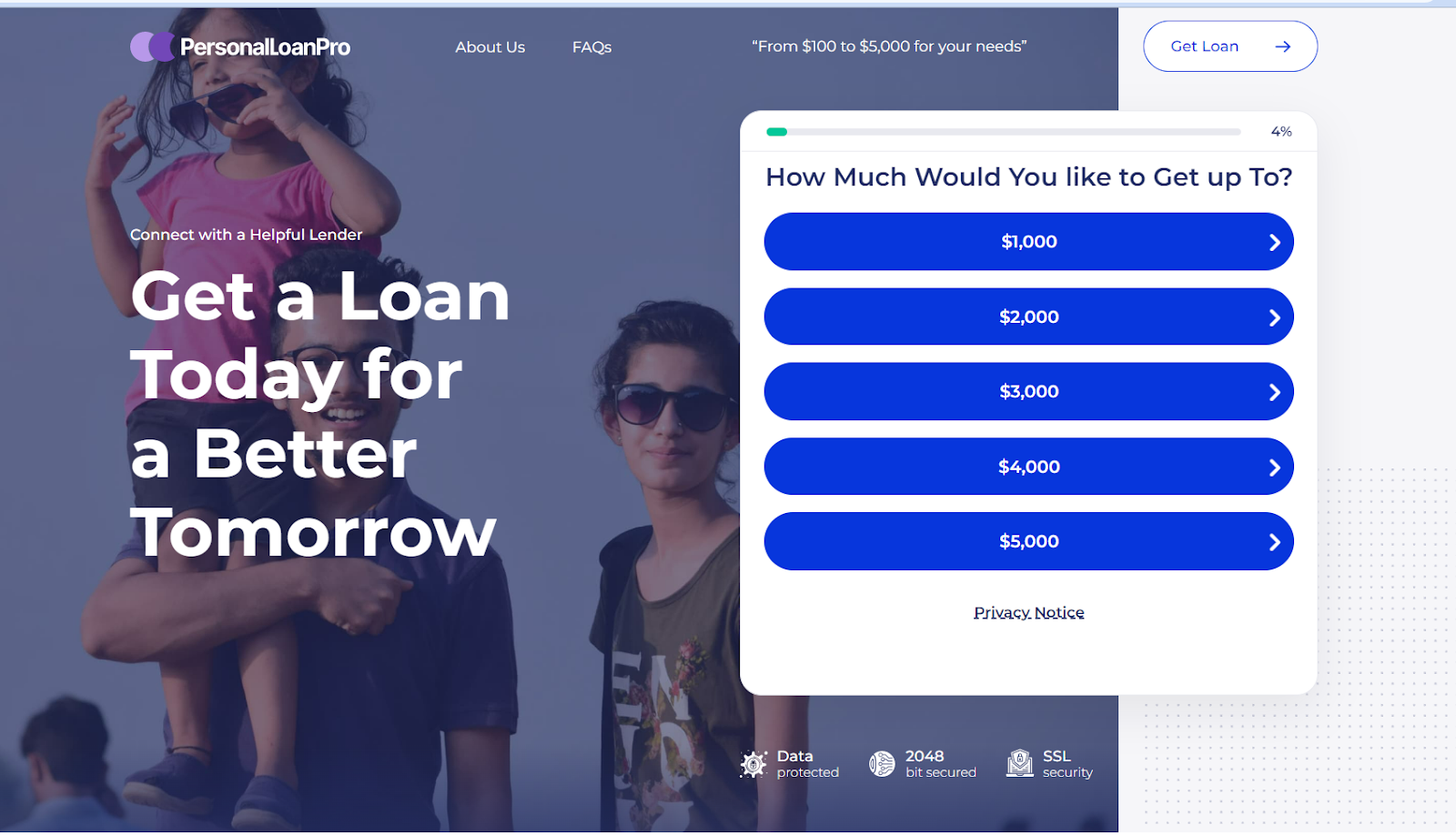

Accordingly, you might not have cash close by in that frame of mind of startling costs. Personal Loan Pro might be an excellent choice to settle that problem.

How Might You Involve a Personal Loan for Startling Costs?

Would it be a good idea for you to wind up confronted with an unforeseen cost that takes steps to burn through every last cent?

A personal loan can give explicit help. This is because, with a personal loan, you initially figure out how much cash you want and afterward apply for an advance of that sum.

A bank will then utilize your loan report and history to check whether you are qualified for that advance and what loan fee will be related to it. All you have to do is get to the right platform; for instance, you can apply for a personal loan at Personal Loan Pro.

The adaptability of Personal advances permits them to be utilized for the accompanying unforeseen or crisis costs:

- Funding home enhancements or the acquisition of a significant machine

- Medical clinic bills for you or another person’s physical issue or veterinarian bills for your little companion

- Wedding, vacation, or other exceptional occasions

- Obligation solidification

There are numerous different purposes for personal loans past the above standard models. Before bouncing into a proposition, in any case, going over how a personal recognition for startling costs works is significant.

With a personal loan, there usually are four primary terms of understanding:

- Principal: Your chief is the entire sum that you are getting today and could possibly incorporate a beginning charge for the loan

- Tenor of the Loan: A tenor is a how much time, whether months or years, that you will be taking care of the loan

- Monthly Installments: This is the settled upon the sum you will be liable for repaying every long stretch of the tenor

- Interest: This variable rate (contingent on various elements) is what the bank charges you to back the advance

5 Ways to Pay An Unexpected Payment with Personal Loans

1. Get some information about an installment plan

Contingent upon the cost, you might have the option to resolve an installment plan. Suppose you’ll have to pay a specialist co-op for the unanticipated expenses.

In that case, they might have programs accessible that permit you to pay what you owe weekly, fortnightly, or month-to-month increases with interest.

Numerous clinical suppliers likewise offer installments to make medical services’ expenses reasonable. You can break the sum you owe into little regularly scheduled installments that work for your financial plan. Far and away superior, the most clinical obligation can be reimbursed without additional interest or expenses.

As long as you maintain your part of the deal by settling upon regularly scheduled installments.

2. Put it on a Visa

You could get a 0 percent APR Visa if you have excellent loan. These cards accompany a limited time without interest, generally between 6 and 21 months.

In a perfect world, you just need to spend however much you can stand to take care of inside the particular period. Alternatively, you’ll pay interest on the excess equilibrium once the early period closes.

If you can’t fit the bill for a 0 percent APR Mastercard or would like to utilize another card you as of now have.

Make sure to devise a system to reimburse your charge sooner than later. Consider making slices to your spending to let loose assets for additional Mastercard installments.

Like that, you will not spend a while or years settling the card and limit how much interest you pay to the Mastercard backer.

3. Think about an personal loan

If you want to get the cash you don’t have rapidly, your ideal choice might be applying for loan. Consider utilizing the moneylender’s web-based prequalification device (if pertinent) for an Personal to decide whether you’re qualified for subsidizing and view potential loan costs. Furthermore, you could save several focuses on your FICO assessment.

Likewise, investigate different choices before you pick an Personal loan item. You might get a special rate from a bank where you have been a client for quite a long time, or you could find an extraordinary loan cost from an internet-based moneylender.

However much you can, consider every one of your choices as you pick a loan to cover your crisis costs.

4. Consider a home value loan

A home value loan is another method for covering startling costs as it allows you to change over a piece of your home’s value into cash.

In any case, it ought to just be utilized if all else fails since it goes about as a subsequent home loan, and you could lose your home on the off chance that you fall behind on installments.

Most moneylenders let you acquire between 80 and 85 percent of the value you’ve developed in your home.

Your value is the distinction between what the house is worth, what you actually owe on the home loan, and some other remarkable advances against the property.

The financing cost on home value advances is commonly severe. However, you’ll require excellent loan to qualify.

Reserves are dispensed in a precise amount and payable in equivalent regularly scheduled payments over a set period.

5. Help the cash through alternate ways

If an installment plan isn’t a choice or you’d don’t really want to utilize the obligation to pay for unforeseen costs, investigate alternate ways of thinking of the assets you wish to. Here are a few plans to kick you off:

- Modify your spending plan in the present moment to make more discretionary cash flow.

- Sell things lying around your home that you longer need.

- Drop any additional administrations or exercises for a short period until you financially recover.

- Put your imaginative abilities to utilize and independents to bring in additional cash.

- Get unspecialized temp jobs or additional time at work to help your profit.

How to Plan for Unexpected Payment?

While you can’t make arrangements for each crisis, you can set aside a secret stash to guarantee that you’ll have cash in the bank on the off chance that a higher cost does come as you would prefer.

Suppose you’re surprised by an unforeseen cost and need to apply for a line of loan. In that case, you can avoid future obligations by making arrangements to take care of that advance.

It’s generally brilliant to talk with a confided-in monetary guide to assist you with getting an installment plan set up because of your financial circumstances.

COMMENTS